Why Modern CFOs Are Moving Beyond Spreadsheets to Smarter Decision-Making

For decades, Excel has been the backbone of finance operations. But in 2025, the cracks in that model are impossible to ignore. Modern CFOs need tools that connect scattered data, automate manual tasks, and surface insights instantly.

The Spreadsheet Strain on SMB Finance Teams

For decades, Excel has been the backbone of finance operations. From budgeting and forecasting to month-end close, CFOs, controllers, and accountants have relied on spreadsheets to wrangle data and answer leadership's most pressing questions.

But in 2025, the cracks in that model are impossible to ignore.

Recent surveys show that:

CFOs spend an average of 2.25 hours per day in Excel doing manual work

(According to NetSuite survey of 186 CFOs).Around 41% of FP&A processes are still manual, amounting to about 10 hours per week of spreadsheet work for skilled finance professionals.

(According to a DataRails survey 200 CFOs).Nearly half of finance teams take 6+ business days to close the books, largely because of manual reconciliations and data preparation.

(According to a Ledge survey of 100 finance professionals).In total, finance teams spend up to 24% of their time on repetitive, low-value manual tasks such as gathering, cleaning, and rechecking data.

(According to an Auditoria survey of 650 finance professionals).

That's time not spent on strategy, forecasting, or shaping smarter decisions.

The Hidden Cost of Manual Data Work

Manual spreadsheet work isn't just a time drain; it's also a significant source of frustration and a barrier to growth.mWhen financial data is scattered across systems, buried in CSV files, or formatted inconsistently, the finance team becomes a bottleneck rather than a catalyst for insights.

Instead of focusing on "why" performance is changing, teams get stuck in the weeds of "what went wrong in column D."This constant cycle of cleaning and reconciling data creates:

Delayed decision-making — critical insights arrive days or weeks late.

Risk of human error — manual entry and version control issues lead to inaccuracies.

Siloed insights — teams operate from different data sources, limiting alignment across the business.

And for SMBs without large data teams, the impact is even greater. Finance professionals end up wearing multiple hats: accountant, analyst, and data engineer — all rolled into one.

From Spreadsheets to Smarter Decisions

Modern CFOs know their value lies not in reconciling data but in interpreting it.

To keep up with today's pace of business, finance teams need tools that connect scattered data, automate manual tasks, and surface insights instantly — without requiring technical skills or months of setup.

That's where Querri comes in.

How Querri Transforms Finance Workflows

Querri is an AI-based data platform built to make data ridiculously easy to use for anyone in business — from CFOs to controllers to accounting firms serving SMBs.

Here's how Querri helps finance leaders move beyond spreadsheets:

1. Any Data, Without the Prep

Upload messy spreadsheets, CSVs, Excel, or JSON files or connect to your Quickbooks or other storage systems, such as Google Drive, S3, Dropbox, ect and your Querri automatically cleans, joins, and prepares the data. No manual formatting, no scripts, no formulas. Just answers.

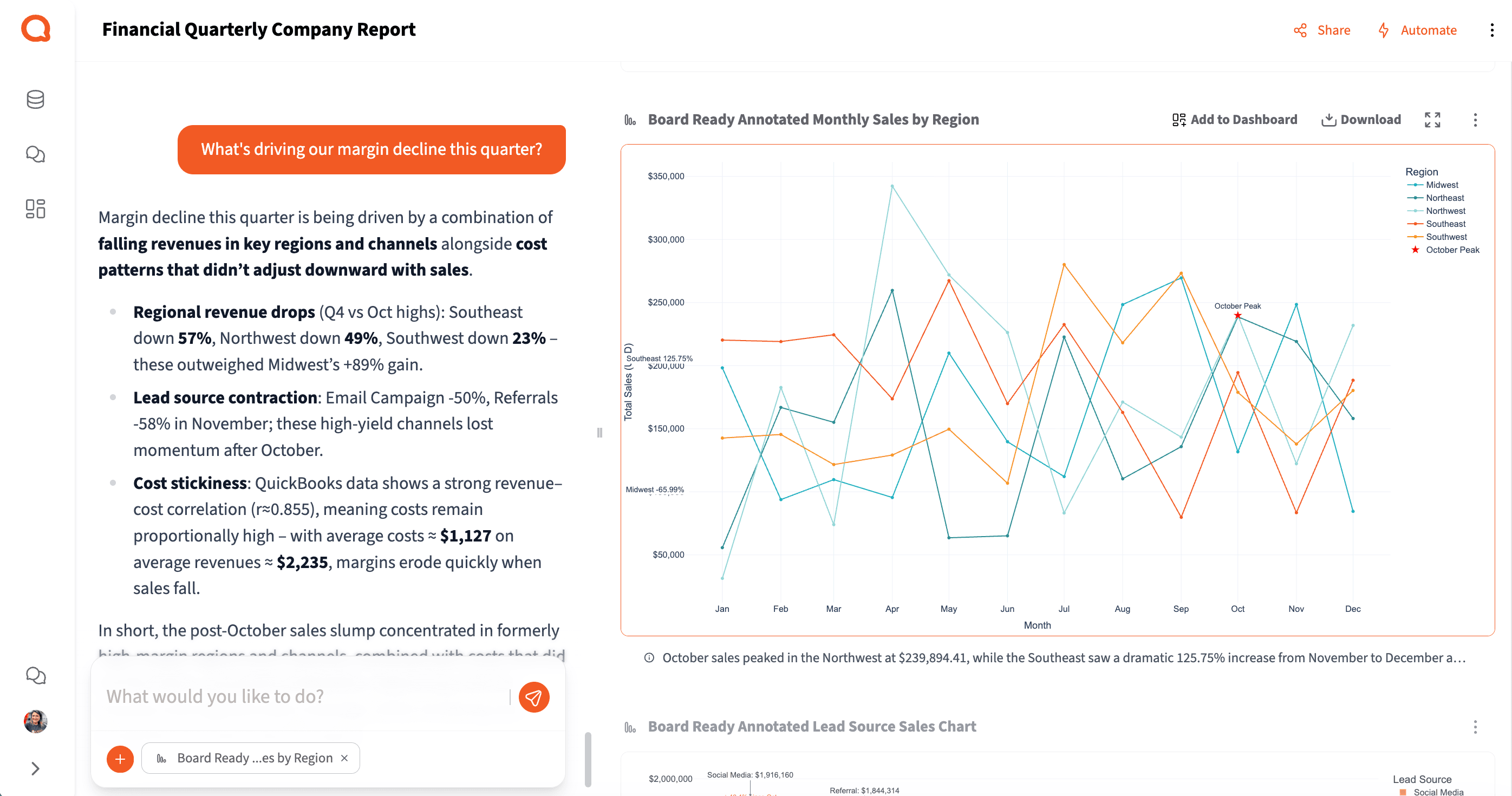

2. Natural Language: The Language of Business

Ask questions in plain English:

"What's driving our margin decline this quarter?" or

"Which clients have overdue payments?"

Querri handles the data logic behind the scenes, surfacing charts, tables, and insights instantly.

3. From Ad Hoc to Automated

Querri lets you turn one-time analyses into repeatable dashboards. Automate your revenue reports, cash forecasts, and expense summaries with a single click — so insights are always up to date.

4. Any Data Size, Beyond Excel's Limits

While Excel caps at a million rows, Querri's modern infrastructure (powered by DuckDB and advanced caching) handles hundreds of millions of rows with lightning speed — no data warehouse setup required.

5. Smarter, Faster, Easier

Querri bridges the gap between business leaders who ask questions and data tools that deliver answers. You don't need to be a data engineer to uncover what's driving profitability, forecast cash flow, or monitor KPIs in real time.

The Impact: Time Back and Insight Forward

By eliminating the need for manual data prep, Querri helps finance teams reclaim hours every week that would otherwise be spent inside spreadsheets.

That means more time for analysis, scenario planning, and leadership strategy.

For accounting firms, Querri turns recurring client work into scalable insights, freeing up staff capacity while increasing client value.

And for SMB CFOs, it's the difference between reacting to data and leading with it.

The Future of Finance Is Conversational

Excel isn't going anywhere — but modern CFOs don't need to live in it. With Querri, finance professionals can spend less time in cells and more time making decisions. In an era where AI can clean, analyze, and visualize data on command, the real power lies in the questions you ask — not the formulas you build.

Querri makes that possible.

It's the modern data tool for modern finance — where insights flow as naturally as conversation, and decisions happen at the speed of business.